- SmallCapInvestor

- Posts

- iRobot (IRBT): Early Move Confirmed, But the Real Upside May Still Be Ahead

iRobot (IRBT): Early Move Confirmed, But the Real Upside May Still Be Ahead

Earlier this week I highlighted iRobot (IRBT) around $4.50 as one of the most compelling asymmetric setups in the small-cap market. It was a distressed robotics leader with high short interest, misunderstood fundamentals, and meaningful strategic value being priced as if it were already finished.

Only a few trading days later, the stock closed at $5.58, reflecting a gain of roughly 25%. That fast upside is notable, but not because it signals the end of the opportunity. Instead, it confirms that the market has begun to recognize the pricing disconnect. The early buying and light covering that has occurred so far represents the beginning of a shift in positioning, not the result of the thesis.

The core catalysts that define this setup have not yet played out. The potential upside path remains open.

The Market Pattern Behind the Setup

In my research on the Beyond Meat (BYND) squeeze, I outlined four recurring criteria that have driven the most explosive short-covering moves of the last cycle:

Recognizable consumer brand

Severe valuation compression from prior highs

Narrative sentiment collapse

High short interest relative to float

iRobot aligns with each point:

Roomba is one of the most widely recognized consumer electronics products of the past two decades.

IRBT shares have declined more than 95% from peak levels.

The failed Amazon acquisition created a perception that the company lost strategic relevance, rather than simply experiencing regulatory disruption.

Short interest currently sits near 29% of the float.

These are not accidental conditions. They form a familiar structure that has historically preceded significant repricing when liquidity and sentiment shift.

Why the Short-Term Trade Still Matters

The move from $4.50 to $5.58 is an initial repricing, not a squeeze. Short sellers have been able to lean on every rally because volume has not been sustained at the levels required to force covering. As volume increases, this dynamic changes.

A breakout through the $6.00 to $6.50 range on strong volume would represent a transition from passive covering to active short exit. That is where momentum traders typically enter and where short sellers begin to lose control of the order flow.

In short-term trading terms, the setup remains intact. The first move confirms interest. The next move begins the actual pressure on short positioning.

Technical Setup: A Long-Term Downtrend Break on Expanding Volume

From a technical perspective, the recent move is significant.

For more than a year, IRBT had been trading beneath a well-defined descending trend line that consistently rejected attempts at recovery. That trend line has now been decisively broken to the upside, with the breakout occurring on expanding volume, which is a notable shift in market participation. At the same time, price has established a rising support trend dating back to April, forming a clear ascending triangle structure.

The breakout above both the downtrend and the $5.00 level suggests the supply dynamic has changed. The 50-day and 200-day moving averages are beginning to flatten and converge, which often signals the early stages of a trend reversal rather than a temporary bounce. RSI has strengthened but is not yet overextended, indicating there is still room for continued upside momentum. If price can consolidate above the $5.00 to $5.20 range and build a base, the next major resistance area is in the $6.00 to $6.50 zone. A high-volume move through that level would confirm a shift from early accumulation to broad momentum participation.

In simple terms, the technicals are now aligned with the fundamental and positioning thesis. The market is beginning to respond, but the structure suggests the move may only be in its early phases.

The Long-Term Value Case Is the More Significant Part of This Story

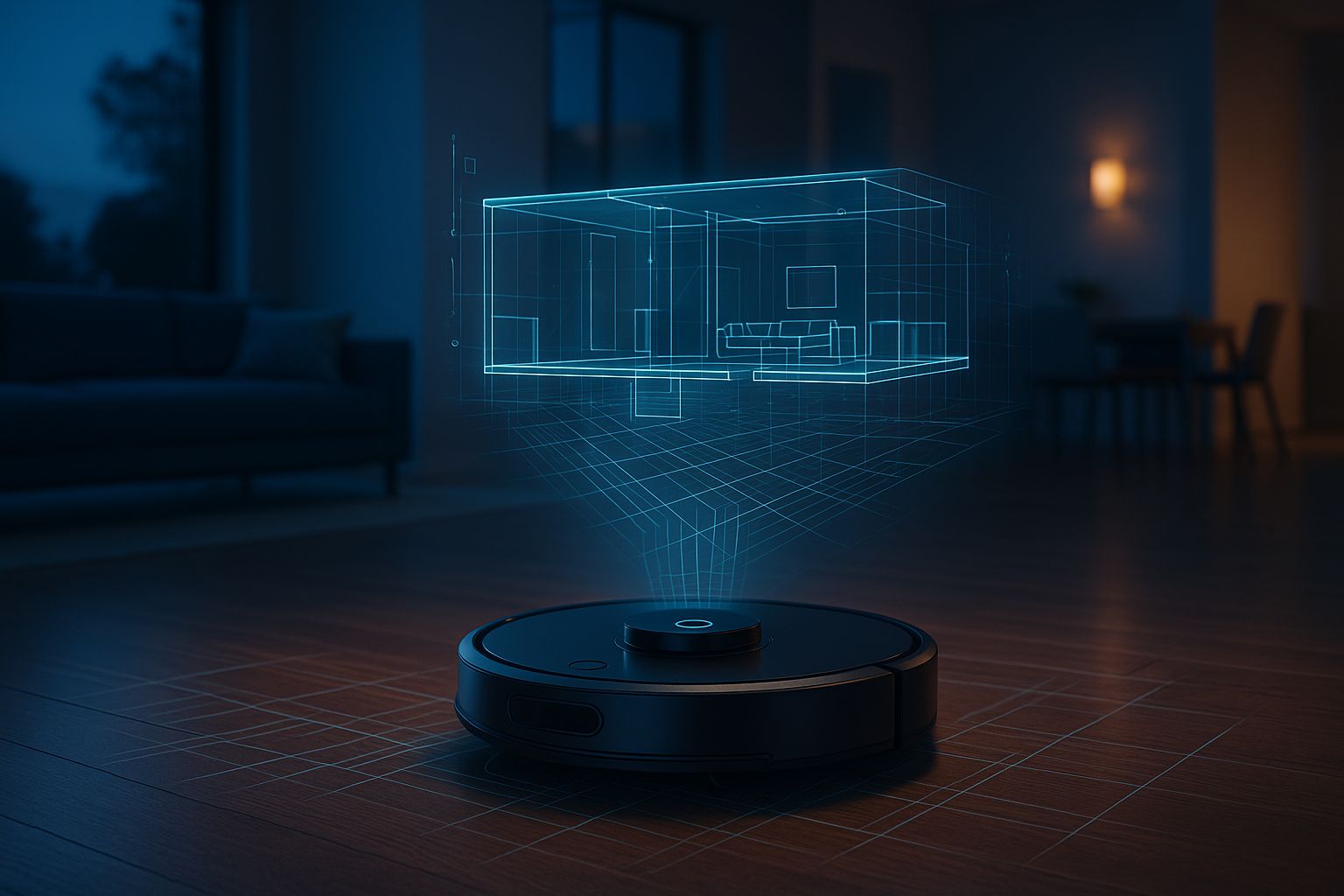

iRobot is not simply a vacuum manufacturer. It is a robotics intelligence and spatial data platform. The consumer hardware is the distribution mechanism. The core value is in the autonomy system, the mapping engine, the machine learning models, and the real-world dataset gathered from devices operating in homes.

Key strategic assets include:

A 35-year robotics R&D foundation

Thousands of patents in navigation, mapping, and sensor integration

A deployed base of more than 50 million connected robots

Each device maps the layout and physical characteristics of the environment it operates in. This produces one of the largest interior spatial mapping datasets in existence. This has strategic relevance to smart home automation, AR and VR environment modeling, embodied AI training, and next-generation consumer robotics.

This is the same value that led Amazon to attempt to acquire iRobot for $1.7B in 2022. The deal failed because of regulatory intervention, not because the underlying asset lost value. The market has priced the company as if the strategic rationale vanished. It has not.

A Turnaround or Acquisition Path Is Plausible

The company is currently carrying approximately $203 million in debt with around $40 million in cash. Covenant waivers have been extended multiple times. If lenders choose restructuring via debt-to-equity conversion at a premium, the balance sheet could reset. If that occurs, iRobot would re-emerge as a de-levered robotics platform with a strategically scarce data asset.

In that scenario, the company becomes an attractive acquisition target for firms such as:

Google

Apple

Samsung

Walmart

Each is working toward increased integration of smart home automation, consumer robotics, or automated in-home logistics.

At the current market capitalization of approximately $150 million, iRobot is trading at a fraction of its demonstrated strategic value.

The Risk: This Is a High-Risk, High-Reward Trade

It is essential to be explicit:

There is real bankruptcy risk.

If restructuring does not occur, if debt conversion cannot be negotiated, or if capital markets access remains closed, the downside risk includes insolvency. This is not a low-volatility investment. It is an asymmetric trade built on structural mispricing, narrative shift, and the possibility of strategic repositioning.

Position sizing and risk discipline matter here.

This is a trade for capital that is intentionally allocated to high-risk, high-reward opportunities, not capital intended for preservation.

Conclusion

The market has begun to recognize the disconnect between iRobot’s current valuation and its underlying strategic value. The initial upward move is confirmation of awareness, not completion of the trade.

From here:

The short-term opportunity revolves around a potential continuation breakout.

The medium-term opportunity involves restructuring or debt conversion.

The long-term opportunity is the possibility of a strategic acquisition or robotics platform turnaround.

The trade remains active. The largest moves occur after conviction broadens, not before.

DISCLAIMER

The author did not receive any compensation for publishing this article. The author holds a position in iRobot Corp and may choose to buy or sell shares of the company at any time without notice. The author does not hold positions in any of the other companies mentioned. While reasonable efforts have been made to ensure the accuracy and reliability of the information provided, readers are encouraged to conduct their own research and seek independent financial advice before making any investment decisions related to the companies discussed.