- SmallCapInvestor

- Posts

- Military Metals Breaks Out - Critical Minerals Are Back in the Spotlight

Military Metals Breaks Out - Critical Minerals Are Back in the Spotlight

It’s finally happening.

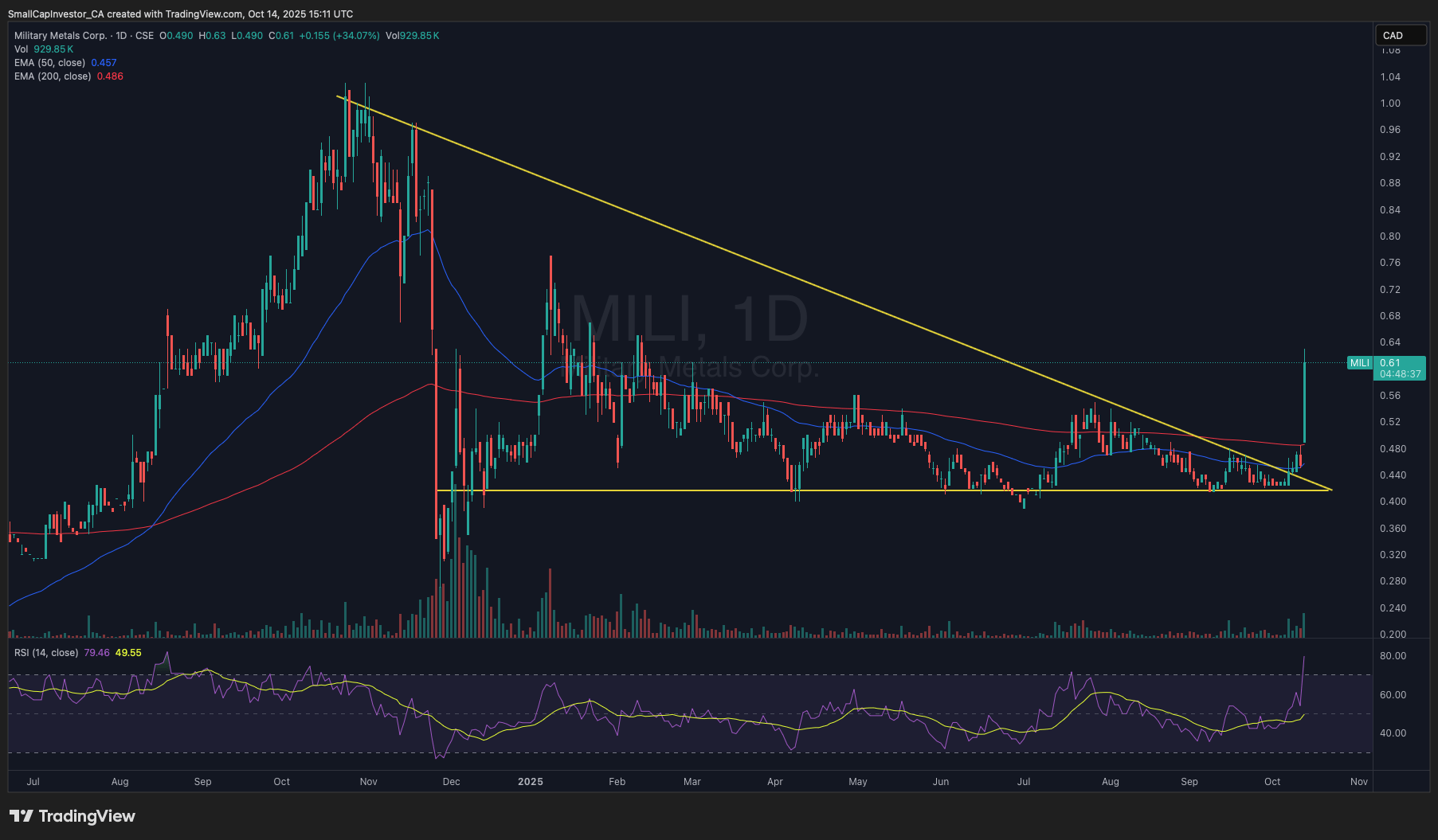

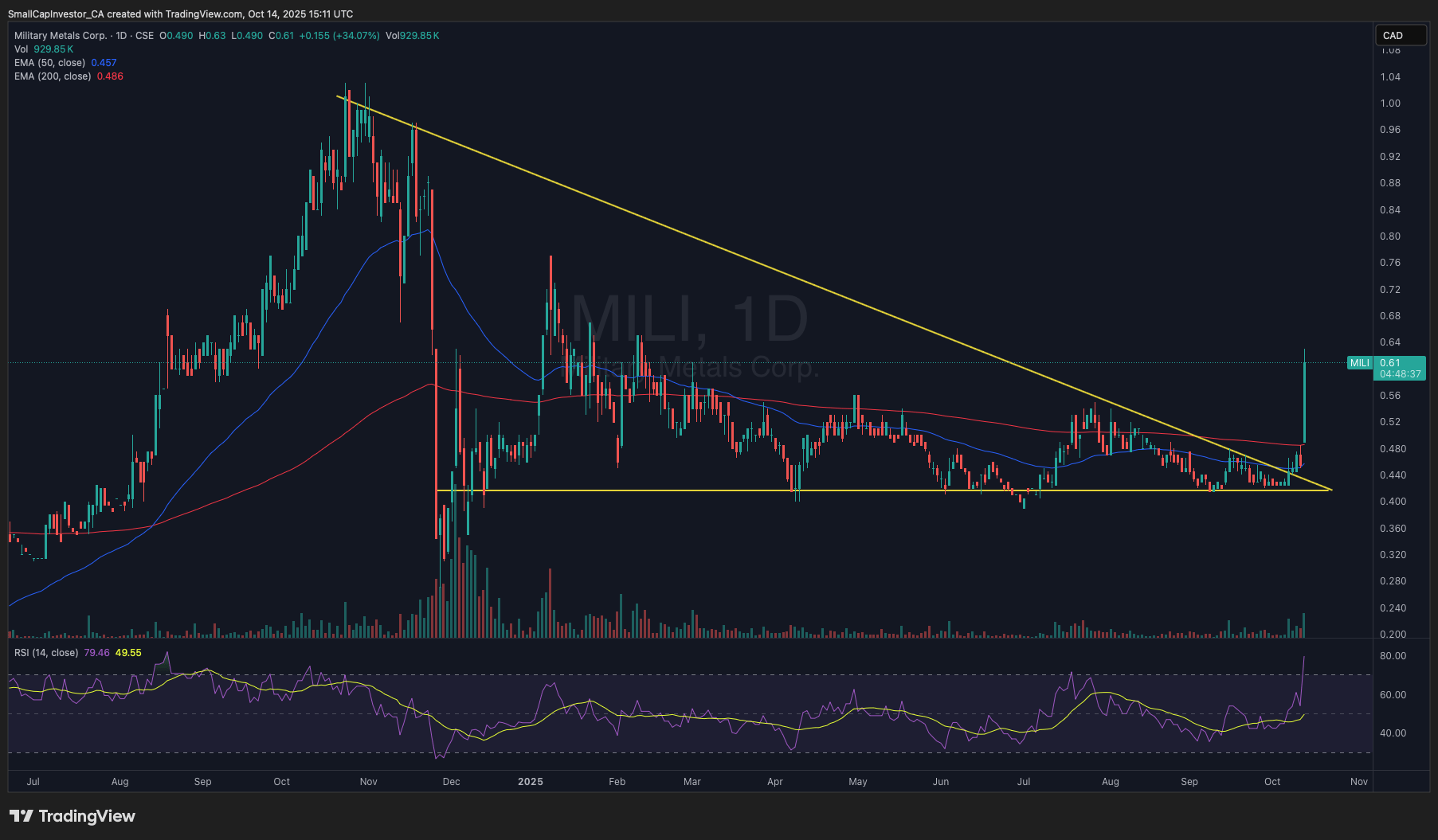

Military Metals Corp. (CSE: MILI | OTCQB: MILIF) — one of our top critical minerals picks for months — is breaking out after a year-long consolidation, and it’s doing so on real news and strong macro tailwinds.

This morning, the company announced new high-grade surface results from its 100%-owned West Gore antimony-gold project in Nova Scotia — including 11.45% antimony and 21.5 g/t gold, confirming the presence of multiple new mineralized zones across the property.

CEO Scott Eldridge noted that this early-stage work is “already beginning to develop new exploration targets overlooked by previous operators,” underscoring how much untapped potential remains at this past-producing mine.

But this story is bigger than one project.

The timing of this development aligns with powerful macro tailwinds driving capital into the critical minerals space. The U.S. government has committed billions toward securing domestic supply chains for materials essential to defense, energy, and advanced manufacturing. China’s export restrictions on antimony have only accelerated the urgency of this initiative.

Major names in the sector are already responding:

$CRML is up sharply on expectations of U.S. government equity participation in domestic projects

$UAMY is gaining momentum as investors rotate into North American antimony exposure

$MP continues to benefit from its position as the leading U.S. rare earth producer

$LAC is advancing on optimism around Department of Energy funding for domestic lithium production

After months of quiet accumulation, Military Metals is finally getting recognized. The breakout on the chart reflects a clear shift in sentiment and could mark the beginning of a new uptrend as the company continues to deliver results.

These names have already taken off. MILI is only beginning to get the love it deserves.

DISCLAIMER

The author did not receive any compensation for publishing this article. The author holds a position in Military Metals and may choose to buy or sell shares of the company at any time without notice. The author does not hold positions in any of the other companies mentioned. While reasonable efforts have been made to ensure the accuracy and reliability of the information provided, readers are encouraged to conduct their own research and seek independent financial advice before making any investment decisions related to the companies discussed.