- SmallCapInvestor

- Posts

- Military Metals Secures Access to Historic West Gore Antimony-Gold Project

Military Metals Secures Access to Historic West Gore Antimony-Gold Project

Big news from one of our watchlist companies.

Military Metals Corp. (CSE: MILI) has just secured surface access to its 100%-owned West Gore Project in Nova Scotia — a historic antimony-gold system that was once Canada’s largest antimony producer.

Here’s why this matters:

West Gore supplied the Allied war effort in WWI with over 7,700 tonnes of 46% antimony concentrate.

Operations were shut down in 1917 after a German U-boat sank its final shipment en route to the UK — bankrupting the mine.

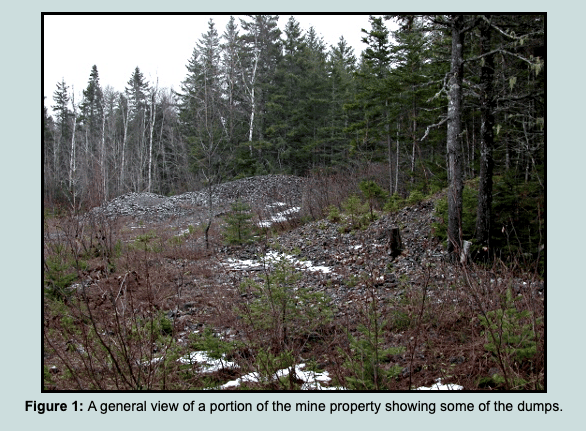

The project still hosts historic stockpiles of gold-antimony mineralized material that remain untested.

Mineralization includes stibnite, native antimony, aurostibnite, and Au-Sb alloys — all within a system open along strike and at depth.

Now, with access secured, MILI is kicking off a 2025 program that includes:

Compilation of historical records

High-resolution drone magnetics

Drill target delineation

At a time when the West is scrambling to secure critical minerals like antimony, and with China still controlling ~90% of global supply, this project is more relevant than ever. Nova Scotia is also actively encouraging new mining development, streamlining permitting and lifting previous restrictions.

This is the first real exploration work at West Gore in over a century. And MILI has it fully consolidated.

This could be one of Canada’s most compelling critical mineral rediscoveries.

YOUR ULTIMATE RESOURCE FOR DISCOVERING SMALL CAP STOCKS.

Disclaimer

The author may own shares in Military Metals Corp. The author may choose to buy or sell shares at any time without notice. Although efforts have been made to ensure the accuracy and reliability of the information presented, readers are encouraged to conduct their own research and seek independent financial advice before making any investment decisions related to the small-cap company mentioned. Adam Giddens, a former CEO and now a director, has been engaged as an Advisor to provide ongoing business support.